Commodity trading is the buying and selling of a wide selection of products including oil, gas, gold & silver. Hedge risk and diversify your portfolio by trading Commodities on MT4.

Trade Gold, Silver, Oil & Gas

Leverage up to 100:1

MT4 & MT5 Platforms on desktop & mobile

Hedge risk & Expand your portfolio

Trade 24 hours a day, 5 days a week

No price manipulation

Diversify your portfolio

Commodities trading represents the buying and selling of set quantities of assets. E.g, Crude Oil and Gold. Commodities trading is typically dominated by energy and metals. Price movements in commodities are usually seen as indicators for the economic health of the wider industry that supplies and demands them.

At ZERO Markets you can trade CFDs on a wide variety of global commodities including gold, silver and oil, all with a trusted broker headquartered in Australia. You can enter and exit trades whenever you want to, close to 24/5, across almost all commodities markets.

Learn to trade Commodities

At ZERO Markets we offer CFDs on our MT4 & MT5 platforms to trade commodities. This form of trading allows you to speculate on the changing prices of commodities without owning the physical commodity you're trading. Essentially, a CFD is a contract between the trader and the broker. For example, if you opened a long (buy) CFD trade on Gold when it was valued at $1,505, and you closed the trade when the price rose to $1,525, you would make a profit $20. If the price fell to $1,500, you would make a loss of $5. In basic terms, you are paying or receiving the difference between the opening and closing price of the commodity being traded.

There are traces of commodities trading as far back as ancient China and 4500 BC where the Sumerians (modern day Iraq) used jugs filled with clay tokens that were shaped to represent the animal or crop they had in their possession. This evolved over time until 1611 when the Amsterdam Stock Exchange was created. It was the world’s first stock exchange and was originally a market for commodity exchange.

The most significant development in commodities trading occurred in 1848 when the Chicago Board of Trade (CBOT) was set up. Its regulated structure provided the exchange of futures and options contracts. Commodities exchanges are now located worldwide with some specialising in multiple commodities or a lone material. Major commodity markets include the Chicago Mercantile Exchange (CME), New York Mercantile Exchange (NYMEX), London Metal Exchange (LME), the Multi Commodity Exchange of India Ltd (MCX) and the Australian Stock Exchange (ASE).

Commodities trading was previously limited to professional traders as it required a substantial amount of time, resources and expertise. Technology and the introduction of additional commodities trading products have changed this. Individuals can now trade commodities using advanced online trading platforms such as MetaTrader 4 and 5. The ways to trade commodities have also expanded to include derivative products such as options, futures contracts, contract for difference (CFDs) and exchange traded funds (ETFs).

A commodity is a tangible good that can be traded or exchanged for products of comparable value. They consist of hard commodities and soft commodities. Hard commodities are natural resources that are mined or extracted such as metals and energy resources while soft commodities are agricultural products or livestock.

Precious metals are rare and remain valuable due to their infinite lifespan and the absence of the prospect of oversupply. The most traded metals are gold, silver, platinum and palladium. Popular metals such as gold and silver can be traded against major currencies in a similar manner to forex trading.

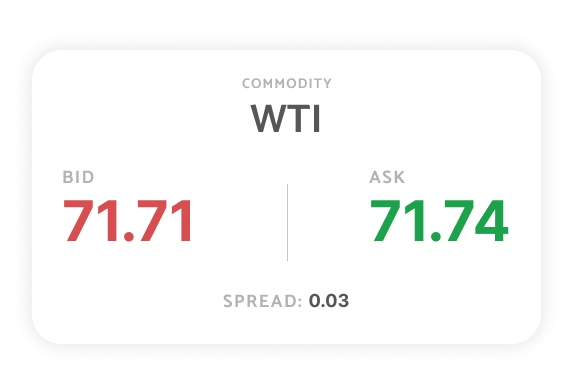

Includes oil, natural gas and other petroleum based fuel products. Crude oil can be refined into petrol, chemicals, lubricant and other products making it the most traded energy source. Brent Crude and West Texas Intermediate (WTI) are the two major types used to benchmark global oil prices.

Relates to major crops and livestock which are in high demand. This includes wheat, rice, corn, coffee, sugar, cotton, oats, soybeans, live cattle, eggs and more. They play a pivotal role in the economy, especially in developing countries which rely heavily on agricultural exports for their economic growth and development.

One of the most interesting characteristics of the commodities market are the factors which impact pricing. Directly related to supply and demand, these include adverse weather conditions such as natural disasters and severe climate changes.

The ability to access commodities using online trading platforms has allowed individual traders to benefit from them. Commodities are often utilised for portfolio diversification as they are generally negatively correlated with stock prices. They are also considered to be an excellent hedging tool against inflation as commodity prices rise when inflation is accelerating. Similarly, many traders invest in commodities to hedge against geopolitical uncertainties such as wars, political events and trade agreements.

Metatrader 4 (MT4) & Metatrader 5 (MT5)

MT4 & MT5 are the favourite choice for commodities traders around the globe. Zero Markets’ MT4 & MT5 are packed with extras to ensure you’re equipped with all the tools you need to make better informed trading decisions. Tight Raw Pricing, fast execution and superior charts are the building blocks for our MT4 & MT5 solutions.

Trade WTI

Opening Price

$39.51 × 0.1 lot = $3,951

Closing Price At $38.51 × 0.1 lot = $3,851Gross Profit on Trade $3,951 – $3,851 = $100

Closing Price At $40.51 × 0.1 lot = $4,051Gross Loss on Trade $3,951 – $4,051 = -$100

The price of WTI is $39.51 and you decide to sell 0.1 lot. The total value was $3,951 USD

Four days later, if the WTI price has increased to $39.51 and you decide to take your profit by selling 0.1 lot WTI. The total value is $3,951 and the gross profit is $100; if the WTI price has increased to $40.51 and the total value is $4,051, the short selling trade loses $100.

Trade from 0.0 pips

| Standard account |

Super ZERO Account |

|||||

|---|---|---|---|---|---|---|

| Symbol | PRODUCT DESCRIPTION | MIN | AVG | MIN | AVG | Mgn% |

| XTIUSD | West Texas Intermediate Crude Oil | 0.05 | 0.05 | 0.05 | 0.0 | |

| WTI | Future Oil | 0.03 | 0.03 | 0.03 | 0.03 | |

| XBRUSD | Brent Crude Oil Cash | 0.05 | 0.05 | 0.05 | 0.05 | |

| XNGUSD | Natural Gas | 0.027 | 0.004 | 0.027 | 0.004 | |

| COFFEE | US Coffee Futures | 2.2 | 2.2 | 2.2 | 2.2 | |

| CORN | Corn / USD Cash | 2.1 | 2.1 | 2.1 | 2.1 | |

| COCOA | Cocoa / USD Cash | 2.5 | 2.5 | 2.5 | 2.5 | |

| SOYBEANS | Soybean / USD Cash | 2.1 | 2.1 | 2.1 | 2.1 | |

| WHEAT | Wheat / USD Cash | 2.1 | 2.1 | 2.1 | 2.1 | |

*Margin (MGN) is a percentage of your equity put aside by your broker to execute trades. This is to cover the possibility of loss in your account. Margin is not a cost or a fee.

Open a Zero Markets trading account today and join over a million others globally trading 2,000+ markets on an easy-to-use platform. Go long or short with competitive spreads on indices, shares, forex, gold, commodities, cryptocurrencies, bonds and more. Plus, get extended hours on major US shares, AI-powered tools and 24/5 client support. Learn more about trading CFDs with Zero Markets.

Licensed & Trusted

Research & Education

Technical Analysis Tools

Transparent Pricing

One-stop Destination

24/5 Live Support

Forex Webinars

Trade On The Go

Same Day Account Opening

Our dedicated team of customer support agents are on hand 24/5 to provide you with multilingual support. Contact Us

Visit our comprehensive FAQ where you can find information about the services we offer and answers to your trading questions. Help Centre

Stay on top of market trends and analysis by following us on social media and visiting our financial markets blog. Blog