step 1

The Sentiment Trader displays information about current and historic long/short sentiment:

the percentage of traders who currently have (or had) an open buy or sell position in a symbol.

The figures are not technical analysis based on price action. They are calculated from realmoney accounts which are being published to www.fxblue.com.

For example:

• 5845 real-money accounts publishing to www.fxblue.com have an open buy position in EURUSD, and 2378 accounts have an open sell position. The app will show that the EURUSD sentiment is 71% long.

The list of available symbols is determined by popularity, i.e. the number of people trading them. For example, sentiment data is not available for CADJPY because there are typically too few traders with an open position to calculate a meaningful percentage.

If a trader has multiple open orders in the same symbol, then the sentiment calculation uses a single net figure for the trader’s positions. For example, if a trader has an open buy order for 1.5 lots and an open sell order for 0.7 lots, then they are treated as being long.

The sentiment percentage is not weighted by volume (because www.fxblue.com has a few users with very large accounts and trade sizes). A trader who is long 0.1 lots has the same effect on the figures as a trader who is long 50 lots.

step 2

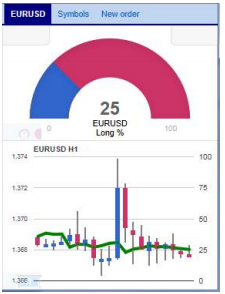

The Sentiment Trader shows the current long/short sentiment (25% long in the following example), and a chart of historic sentiment plotted against price action. In the example below, sentiment has remained consistently below 50%, i.e. a majority of traders have been short EURUSD.

2.1 Changing the display of current sentiment

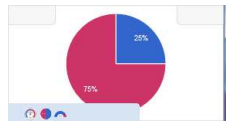

You can change the way that current sentiment is displayed using the pop-up bar in the bottom-left of the chart. There are three options: a dial; a pie chart; and a gauge (the default).

2.2 Changing the display of historic sentiment

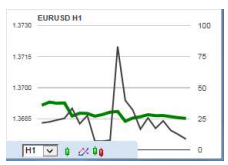

You can change the way that historic sentiment is displayed again using a pop-up bar in the bottom-left of the chart:

You can choose the timeframe for the historic chart (e.g. M5, H1), and three different types of chart:

• Price candles vs sentiment (the default)

• A line chart of close prices vs sentiment (as illustrated above)

• “Sentiment candles”: these show the range of sentiment values, rather than just the closing value, within each time bar (M5, H1 etc)

2.3 Current open position

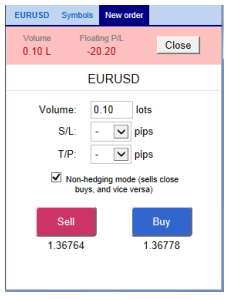

The boxes at the top of the display show any open position in the selected symbol. In the following example, the trader is long 0.1 lots EURUSD, and the current P/L of that position is a loss of 20.20:

2.4 Switching between symbols

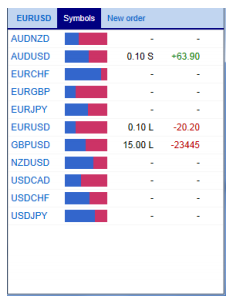

You can switch between different symbols using the Symbols tab at the top of the app.

This displays a list like the example below which shows the symbols; the current long/short sentiment as a bar; any open position which you have in the symbol; and the P/L of the open position.

You can switch the main display to a different symbol by clicking on its name in this list.

2.5 Opening and closing positions

[Please note: the order tab is not available on the tradable platform]

You can use the New Order to carry out simple trading actions such as closing an open position or opening a new one.

The top of the trading form shows any open position in the selected symbol, with a button for closing the position. Below that is a simple form for placing a new buy or sell market order.

Open a Zero Markets trading account today and join over a million others globally trading 2,000+ markets on an easy-to-use platform. Go long or short with competitive spreads on indices, shares, forex, gold, commodities, cryptocurrencies, bonds and more. Plus, get extended hours on major US shares, AI-powered tools and 24/5 client support. Learn more about trading CFDs with Zero Markets.

Licensed & Trusted

Research & Education

Technical Analysis Tools

Transparent Pricing

One-stop Destination

24/5 Live Support

Forex Webinars

Trade On The Go

Same Day Account Opening

Our dedicated team of customer support agents are on hand 24/5 to provide you with multilingual support. Contact Us

Visit our comprehensive FAQ where you can find information about the services we offer and answers to your trading questions. Help Centre

Stay on top of market trends and analysis by following us on social media and visiting our financial markets blog. Blog