step 1

The Correlation Matrix shows the correlation between symbols over a configurable time-frame and number of bars, for example the last 100 H1 bars

Correlation is measured on a scale from -100 to +100:

Correlation can have a major effect on your trading risk. For example the following charts show H1 EURUSD and USDCHF over the same time period:

These symbols had very strong negative correlation (about -95). If you were long EURUSD and short USDCHF over this period, or vice versa, then you would have seen very similar profits on both positions. In effect, you did not have two positions: you only really had one position. (If you were long both symbols, or short both symbols, then you probably had a profit on one and a matching loss on the other.)

It is generally advisable to minimise the correlation between your open positions. Otherwise, you are either trading the same price action twice over, or you have two positions which cancel each other out.

The Correlation Matrix helps you to identify symbols with strong or weak correlation.

step 2

2.1 Matrix

The Correlation Matrix shows the correlation between a grid of selected symbols.

For example:

Each cell in the matrix is color-coded:

It makes little difference whether values are positive or negative (e.g. +90 or -90), and the meaning depends on whether you are long or short each symbol.

For example:

The chequered cells show rows and columns which are the same (i.e. correlation of EURUSD against itself is meaningless). The grid is symmetrical either side of the chequered line: e.g. the correlation of EURUSD against USDCHF is the same as the correlation of USDCHF against EURUSD.

2.2 Changing the parameters for the calculation

You can use the fields at the top of the matrix to choose a timeframe (e.g. H1, D1) and a number of historic bars (e.g. 25, 100, 500). Correlation between symbols changes over time, and recent correlation may not continue in future. As a general rule, the settings which you choose should be related to how long you intend to keep open positions for. For example, if you expect a position to be open for 24 hours, you might want to look at H1 correlation over the last 50 or 100 bars (roughly 2 or 4 days).

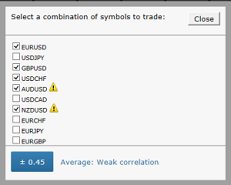

You can choose which symbols to include in the Matrix by using the … button. This shows the list of symbols which are currently being displayed, and a list of all available symbols.

2.3 Highlighting correlation strength

The strength field, next to the bars field, lets you highlight different types of correlation in the grid. For example, if you pick “Strong” then the grid highlights correlation above ±75, and grays out all weaker correlations.

2.4 Trade list

The Trade List button shows the average correlation between a list of selected symbols – for example, positions you are currently trading, or positions which you intend to open in future. The list shows the average correlation, and also marks any symbols which have strong correlation with another symbol on the list. In the following example the overall average is weak correlation, but AUDUSD and NZDUSD have strong correlation with each other:

Open a Zero Markets trading account today and join over a million others globally trading 2,000+ markets on an easy-to-use platform. Go long or short with competitive spreads on indices, shares, forex, gold, commodities, cryptocurrencies, bonds and more. Plus, get extended hours on major US shares, AI-powered tools and 24/5 client support. Learn more about trading CFDs with Zero Markets.

Licensed & Trusted

Research & Education

Technical Analysis Tools

Transparent Pricing

One-stop Destination

24/5 Live Support

Forex Webinars

Trade On The Go

Same Day Account Opening

Our dedicated team of customer support agents are on hand 24/5 to provide you with multilingual support. Contact Us

Visit our comprehensive FAQ where you can find information about the services we offer and answers to your trading questions. Help Centre

Stay on top of market trends and analysis by following us on social media and visiting our financial markets blog. Blog